ventura property tax rate

Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration Monday through Friday between 800 am. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes.

County Of Ventura Webtax Tax Payment History

California Propositions 60 and 90.

. Revenue Taxation Codes. This article will show you some of the most common property tax exemptions for seniors and how to determine whether youre eligible for them. Propositions 60 and 90 are pieces of legislation that allow homeowners 55 or older to move into a new home without substantially increasing their property tax obligation.

For residents this means that the current tax rate on a 400000 house has a price tag of 1604 in property taxes per year while under the proposed tax increase the amount jumps to. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. TAX CITY LEVY.

Ventura County collects on average 059 of a propertys assessed fair market value as property tax. We are accepting in-person online and mail-in property tax payments at this time. Cook County collects on average 138 of a propertys assessed fair market value as property tax.

The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700. The tax on the property was 1 of assessed value statewide plus local taxes. The County is committed to the health and well-being of the public.

Revenue Taxation Codes. Transfer California Property Tax for Homeowners 55 and over. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year.

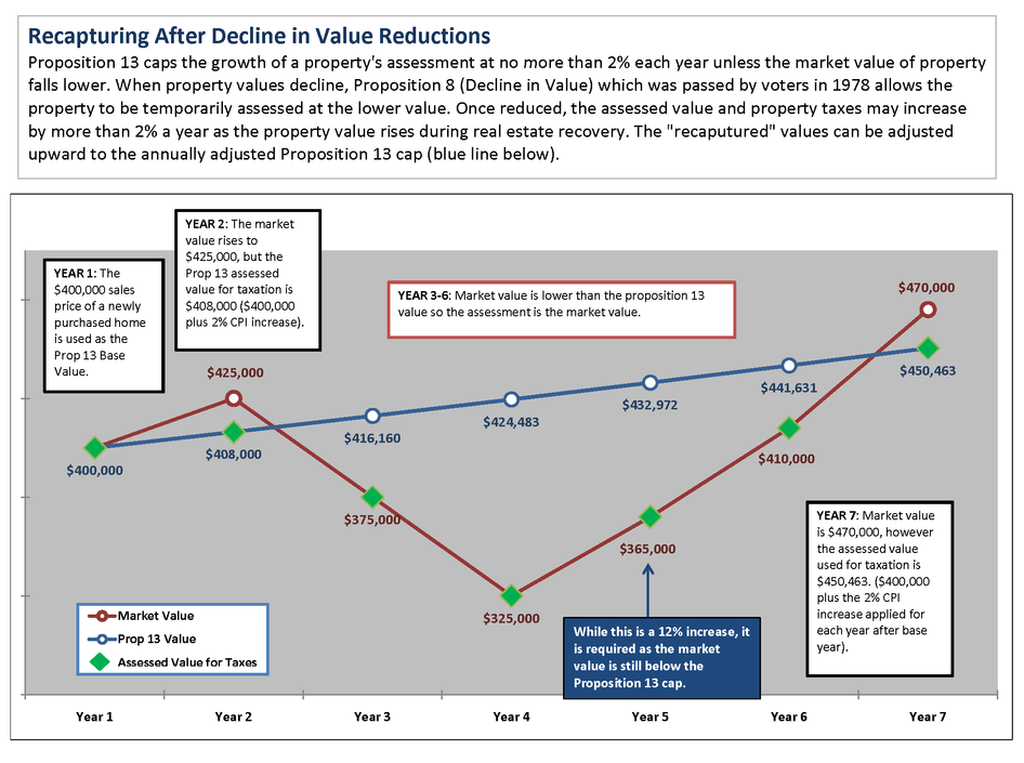

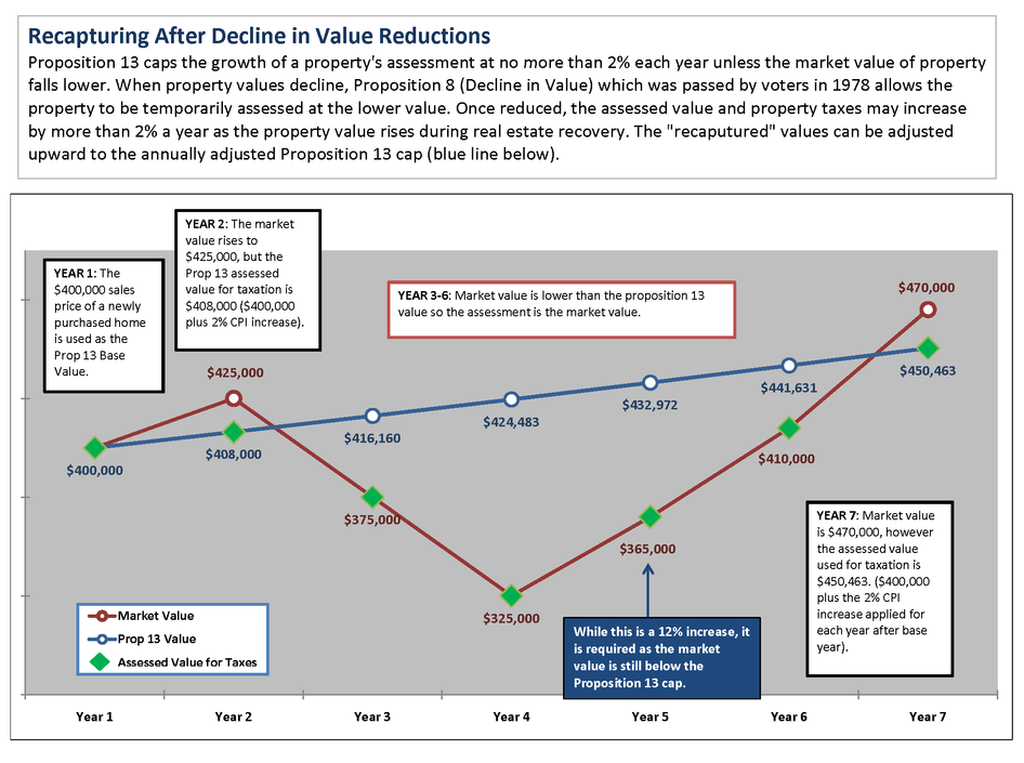

And in between owners the assessed value of a property could increase by a rate of up to 2 per year. The caveat here is the market value of the new house generally must be lower or equal to the home being sold. Alameda County Assessor 1221 Oak St Room 145 Oakland CA 94612 Phone.

Operating Levy. Ventura County has one of the highest median property taxes in the United States and is ranked 123rd of the 3143 counties in order of median property taxes. SCHEDULE A Page 3 of 64.

Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes. California homeowners 55 and older can get a one-time opportunity to sell their primary residence and transfer the property tax assessment to a new home under Proposition 60. Excluding Los Angeles County holidays.

PROPERTY TAX NET ASSESSED. In 1978 Californias Prop 13 declared that California property owners could only reassess their homes for market value when they were selling. 2021 2021 2021 DIST.

The property tax rate in the county is 078.

California Public Records Public Records California Public

Pay Property Taxes Online County Of Ventura Papergov

Every County In America Ranked By Scenery And Climate Beautiful Places In America Places In America North America Map

Ventura County Ca Property Tax Search And Records Propertyshark

Ventura County Assessor Notification Of Assessment

Ventura County Assessor Supplemental Assessments

Lansner Hiring May Boost Housing Outlook House Prices Housing Market Mortgage

Prop 8 Decline In Value And Prop 13 Property Tax Limits Ventura County

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Ventura Cpa Bill Soderstedt Furniture Storage Decor

Ventura And Los Angeles County Property And Sales Tax Rates

County Of Ventura Webtax Supplemental Tax Calculator

Ventura County Ca Property Tax Search And Records Propertyshark

Ventura County Assessor Esdr Electronic Business Property Filing

Pay Property Taxes Online County Of Ventura Papergov

Ventura County Ca Property Tax Search And Records Propertyshark